#031: Learning New Things, Investing, and RRR Updates

Read Time: 4 mins. 6 secs.

On this week’s Rat Race Running Newsletter:

RRR Update

RRR Article of the Week

3 Principles to Maximize Your Potential for Learning New Things

RRR Tweet of the Week

RRR Investment Update for the Week

RRR Updates:

Sorry for missing last week’s send-out, as we didn’t have electricity due to Supertyphoon Pepito. I was also recovering from the flu I had last weekend.

Facebook: We’re now at 42,500 followers on the platform! Thank you everyone for your support! 50,000 followers by year-end suddenly became a possibility.

Instagram: After 1,600+ posts, my IG account finally cracked 300 followers.

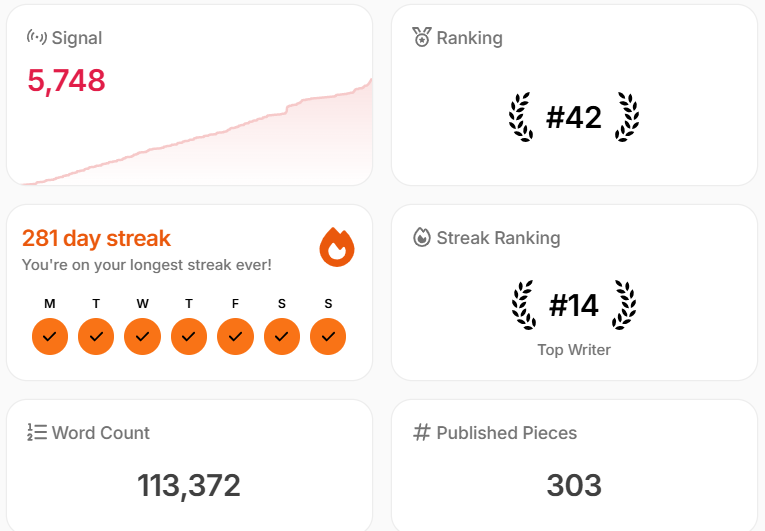

Typeshare: I currently hold the 14th-longest writing streak (281 straight days writing atomic essays) among 75,000+ writers on a platform. I have also written 300+ pieces with over 113,000+ words (Maybe I should convert it to a book?).

RRR Article of the Week:

Sometimes, we think the best way to learn is through the strategy that works for us.

For instance, I learn more through reading and writing. I am also high on intrapersonal intelligence and have a top strength of "context" and "learner" based on the Gallup Strenghtfinder.

So, if you're wondering how to learn better, here are some things you should discover:

#1. Know your learning style.

Under the VARK Model, there are four predominant learning styles: visual, auditory, read/write, and kinesthetic.

Identifying which suits you better will help you select the media you consume. For instance, visual learners can use videos, auditory learners can use podcasts, read/write learners should use books and notes, and kinesthetic learners learn by doing.

Understanding yourself better will help you maximize your learning time.

#2. Know your type of intelligence.

I believe in Howard Gardner's theory of multiple intelligences, which tells that everyone is intelligent, just under different applications.

The eight intelligences are Visual-spatial, Linguistic-verbal, Logical-mathematical, Body-kinesthetic, and Musical. Interpersonal, Intrapersonal, and Naturalistic. You'll notice that your intelligence type may also coincide with your learning style and strength profile.

Understanding your intelligence type will help you accept that you're also intelligent, just not in a school setting.

#3. Know your Gallup strength profile.

The Strengthsfinder personality test can identify your strengths based on 34 themes. Through this test, I learned that my primary strength was in Context, which says:

"People exceptionally talented in the Context theme enjoy thinking about the past. They understand the present by researching its history."

I then realized that I love history and learning from other people's mistakes because it's my strength. However, you may have a different strength, which you can apply in collaboration with others, supplementing their weaknesses.

By knowing your strengths, you can focus on them and collaborate with people to compensate for your weaknesses.

RRR Meme of the Week:

Hot topic yung mga magulang na ginagawang retirement fund ang mga anak nila. Pero meron ding mga anak na ginagawang emergency fund ang mga magulang nila. Let's learn to carry our own weight.

Meme provided by Ryan (RRR Co-Meme Maker)

Book Quote of the Week:

A Tweet from Me:

An Interesting Tweet From Others:

Warning: Friendship and business don’t always mix.

RRR Investment Update

Investing Insight: The $PSEi is back below the 7,000 level. Will we see another Santa Claus Rally this year, or will it go lower? Either way, buying battered dividend stocks and REITs is a good time if you’re a dividend investor.

Dividend Portfolio Update: We (my wife and I) have FIVE upcoming dividend payments in the next 30 days, which motivates me to continue with this dividend harvest strategy.

Our non-REIT positions now occupy half of our asset allocation after the prices went below my entry price, while our REITs are a third of our positions.

Our cash also fell as we used it to buy more shares as the prices dipped.

REIT Updates: More REITs have declared their 3Q dividend payments, which is great news for dividend investors.

Upcoming ex-dates:

$AREIT - Nov. 26, 2024 (P0.48 per share)

$CREIT - Dec. 11, 2024 (P0.049 per share)

$VREIT - Dec. 12, 2024 (P0.04667 per share)

DISCLAIMER: This is not a recommendation to buy, sell, or hold. I am only sharing this to show the difference between each REIT’s current dividend yield.

See you again next Monday at 8 AM Philippine Time — RRR

Did you enjoy this? Share it with a friend. ;)

Follow Me on Social Media:

Facebook - facebook.com/ratracerunning

Twitter/X - x.com/ratracerunning

Typeshare - typeshare.co/ratracerunning