#030: Financial Goals, Retirement, and RRR Updates

Read Time: 4 min. 28 secs.

On this week’s Rat Race Running Newsletter:

RRR Update

RRR Article of the Week

3 Reasons Why We Should Always Revisit Our Financial Goals

RRR Thread of the Week

3 Reasons You'll Probably Not Have Enough by the Time You Retire

RRR Investment Update for the Week

RRR Updates:

Facebook: We finally reached 35,000 followers on the platform! When the page reached 20,000 followers in September, I set an *unrealistic* goal of reaching 35,000 by year-end, yet here we are! Thank you everyone for your support!

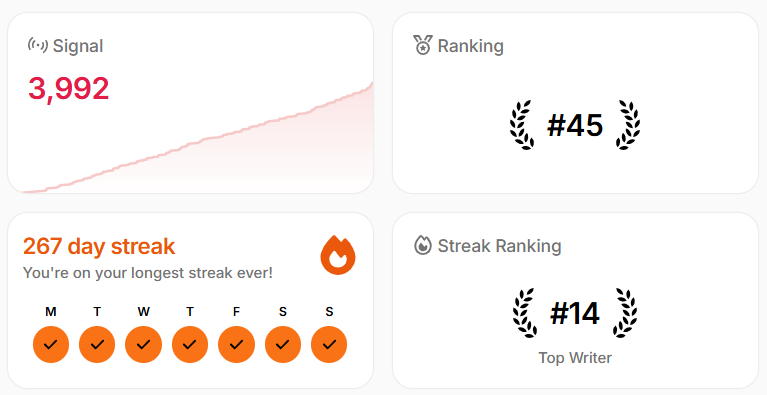

Typeshare: I currently hold the 14th-longest writing streak (267 straight days) among 75,000+ writers on a platform.

RRR Article of the Week:

We should reevaluate our financial goals, like how we should do the same with life goals.

In a matter of a few years, our financial lives will not be the same. Even if we stay still, the world will continue moving, leaving us in the process. And the ever-increasing inflation and the surge in the cost of living will still force us to rethink our finances.

Here are some reasons we should sit down and reevaluate our financial goals.

#1. To check if we're still moving in the right direction.

When we have a long-term goal, we should always check to see if we're making progress.

For instance, when planning for our retirement, a lot can happen in the next three or so decades. Can you imagine if you bought the old mining stocks in the '80s, hoping to use your stock market holdings for your retirement, only to find out it lost most of its value?

Or if you've been saving for a downpayment on a house for the past five years only to realize that you already had the money two years ago because you didn't check.

You should revisit your financial goals at least once a year to see if you're still on track.

#2. To reallocate resources after completing a goal.

When you complete a financial goal, you must reallocate it quickly to another goal, or it will disappear in the void of ever-dominant lifestyle inflation.

For instance, you finished paying your 15-year mortgage two years earlier because you're advancing your payment for your principal. You can use your freed-up money to add to your child's education fund or your retirement fund for an earlier retirement.

It's easy to find an expense for our extra money, so knowing where they should go is crucial.

#3. When our circumstances may have changed.

A lot can happen in just a few years, leading to changes in your financial goals.

For instance, getting married is one of the biggest changes anyone can have. Our goals when we were single wouldn't apply anymore, so we had to adapt.

Another circumstance is being laid off from your job without an emergency fund. You may want to use your travel fund to finance your next few months of survival.

It's important to be adaptable and learn how to prioritize.

RRR Meme of the Week:

A reality in the job market.

Having high grades is good, but having the ability to sell yourself is better.

Book Quote of the Week:

RRR Thread of the Week:

An Interesting Tweet From Others:

Just do it.

RRR Investment Update

Investing Insight: I use annualized dividend yield over TTM (trailing twelve months) dividend yield when evaluating stocks because it helps me “look forward.” This strategy has helped me several times avoid declining REITs.

The $PSEi is back below the 7,000 level. Will we see another Santa Claus Rally this year, or will it go lower? Either way, it’s a good time to buy battered dividend stocks if you’re a dividend investor.

Dividend Portfolio Update: Three of my dividend stocks/REITs announced dividend payments last week, bringing my expected dividend payments to five.

My non-REIT dividend stock allocation currently has the highest portfolio allocation after trimming some of my REITs. I'm still waiting to see if the index will go lower.

REIT Updates:

$VREIT leads the REIT sector with a 10.16% annualized yield, while problematic $DDMPR and $FILRT are the other stocks with at least an 8% yield. $MREIT and $RCR, on the other hand, are above 7%, which is also attractive.

The bottom three yields are currently too low for my criteria, which is why I prefer investing in non-REIT dividend stocks at the moment.

DISCLAIMER: This is not a recommendation to buy, sell, or hold. I am only sharing this to show the difference between each REIT’s current dividend yield.

See you again next Monday at 8 AM Philippine Time — RRR

Did you enjoy this? Share it with a friend. ;)

Follow Me on Social Media:

Facebook - facebook.com/ratracerunning

Twitter/X - x.com/ratracerunning

Typeshare - typeshare.co/ratracerunning