#028: Small-Town Mentality, Minimalism, and RRR Updates

Read Time: 4 minutes

On this week’s Rat Race Running Newsletter:

RRR Update

RRR Article of the Week

4 Dangers of Having a Small-Town Mentality

RRR Thread of the Week

3 Simple Ways To Integrate Minimalism to Make Life a Little Better

RRR Investment Update for the Week

Closed Trades: $CREIT

RRR Updates:

Facebook: I added two additional content types to add more variety.

RRR Memes of the Day:

Book Quotes of the Day:

Typeshare: After eight months, I wrote over 100,000 words!

RRR Article of the Week:

Living in a small town in the province is one of many people's goals for its simplicity.

However, those who have stayed in a small town long enough may have developed a small-town mentality. They are often stagnant, uninterested in other ideas, and only interested in what's happening in their small community - as if nothing significant is happening outside their town. I noticed this with some previous colleagues.

Here are four dangers I noticed with people with a small-town mentality.

1. You Will Not Grow Beyond Your True Potential.

You'll never realize your full potential if you never leave your hometown, even for a while.

It's like being the biggest fish in a small pond. Sure, you're good compared with the same people in your small town, but you don't realize there's a vast ocean with much bigger fish outside. It's like why some people seemed to peak in their high school; they never ventured outside.

To realize your true potential, you must realize there's more to what you know.

2. You Will Miss Out on Opportunities.

The small-town mindset is a great limiter.

I saw many people with great potential but chose to stay in their hometowns because it's safe and familiar. I'm not saying that you should leave your hometown and never return. Instead, go outside, explore for some time, and then apply the knowledge you have acquired back to your hometown.

As they say, if you want to improve your and your family's life, one generation must take the leap.

3. Gossip as a Way of Life.

The gossip culture is one of the worst things about people with small-town mindsets.

Since they live in a seemingly confined space, what is happening around them is the only reality. Some think it's their duty to "share" what's happening in other people's lives. However, they hate being called a tsismoso/tsismosa.

Though the rise of "marites" became a more acceptable title.

4. You Will Be Afraid to Make a Change.

If you've lived in your hometown or home province for so long, you will likely be absorbed by the prevailing system or "sistema."

Some people use their power and influence to get ahead, not knowing they already practice corruption. They will then defend what they do by saying something like, it is what it is or "Ganito na talaga. Wala nang magagawa."

Change is difficult, and if you don't make a conscious effort to move away from having a small-town mentality, then you will be trapped.

RRR Thread of the Week:

When I started Rat Race Running, minimalism was one of the key points. It helped me distinguish between the essentials and the non-essentials.

An Interesting Tweet From Others:

Progress compounds over time. At first, it felt like nothing was happening, but then suddenly, it grew almost overnight.

RRR Investment Update

Investing Insight: Looking at my trading analytics, I realized all my losses occurred when I traded non-dividend stocks in the middle of the year. If I just stuck to trading REITs and dividend stocks, I would've been more profitable. I won’t make the same mistakes next year.

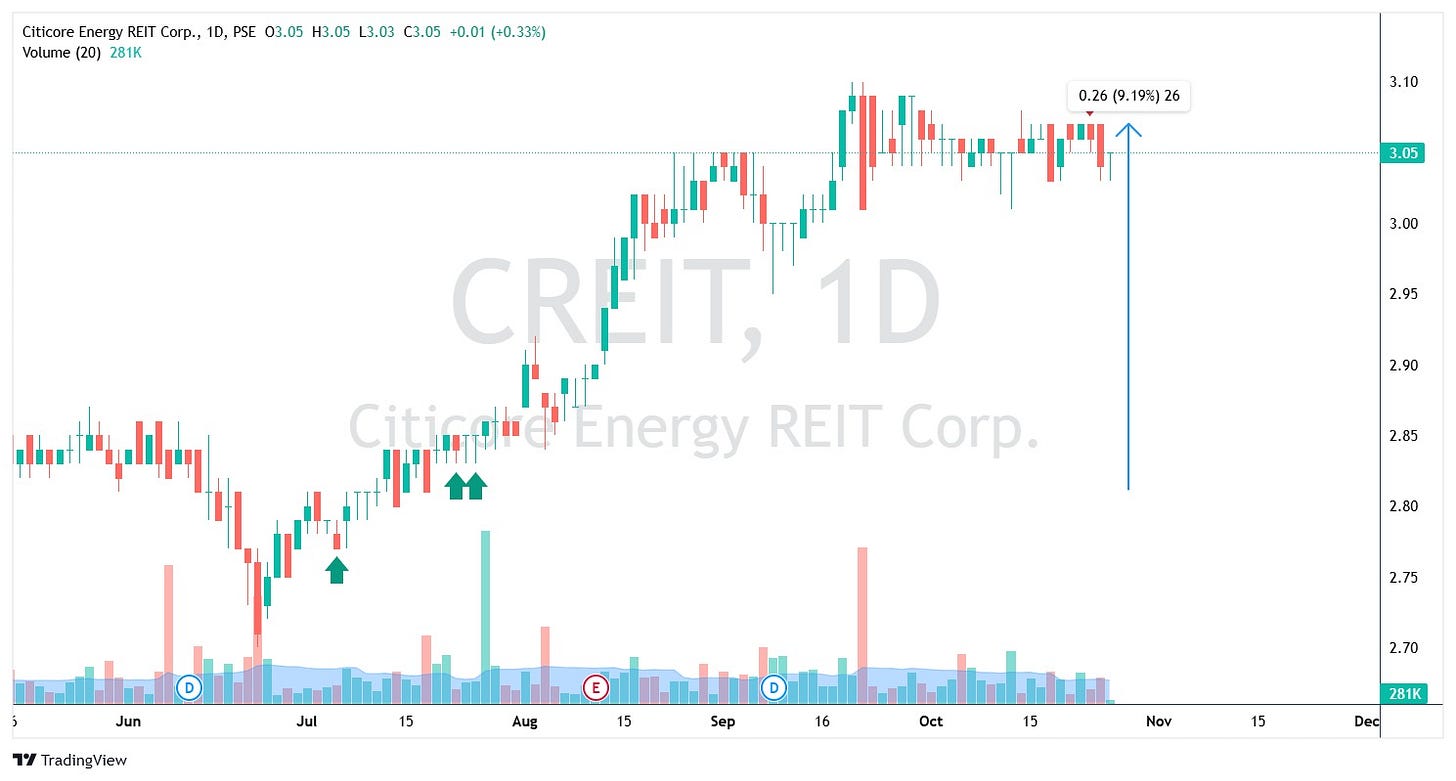

Closed Trade: $CREIT

This is my second trade for $CREIT this year. As I mentioned in a previous post, I like to take my dividends in “advance” by selling the stocks once my P/L reaches above their annualized yield.

Afterward, I added the trade proceeds to buy more of this dividend stock I’ve been holding on to, waiting for its second dividend payment.

Clue: It’s related to gold.

Portfolio Update: Two of my non-REIT stocks declared special dividends, so I have something to look forward to in November. Hopefully, the REITs will declare soon.

My non-REIT percentage increased because I sold CREIT and added more positions to $OGP last week.

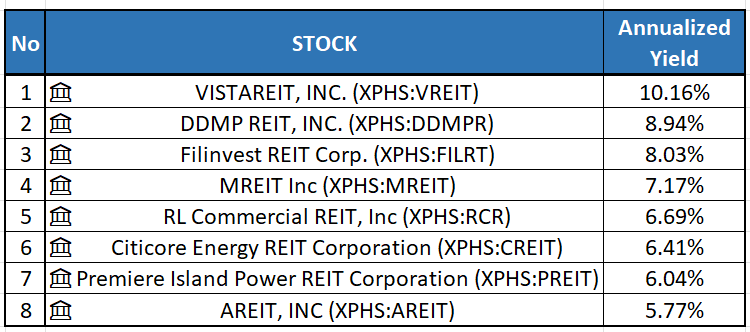

REIT Updates: $VREIT, $DDMPR, and $FILRT are now just the three REITs with more than 8% annualized yields. Market-favorite $AREIT remains below a 6% annualized yield.

DISCLAIMER: This is not a recommendation to buy, sell, or hold. I am only sharing this to show the difference between each REIT’s current dividend yield.

See you again next Monday at 8 AM Philippine Time — RRR

Did you enjoy this? Share it with a friend. ;)

Follow Me on Social Media:

Facebook - facebook.com/ratracerunning

Twitter/X - x.com/ratracerunning

Typeshare - typeshare.co/ratracerunning