#026: Basic Money Skills, Essential Adulting Skills, and RRR Updates

Read Time: 6 minutes

Speaking Time: 8 minutes

Here are the two better-performing articles for the week:

5 Basic Money Skills Every Single Young Professionals Have to Learn to Prepare for Their Future

4 Adulting Skills Fresh Graduates Should Learn Early That Pays Dividends in the Future

You’ll also find:

Rat Race Running Update

RRR Thread of the Week - 4 Reasons Why Living Debt-Free Will Give You a Better Life

RRR Investment Update for the Week

RRR Updates:

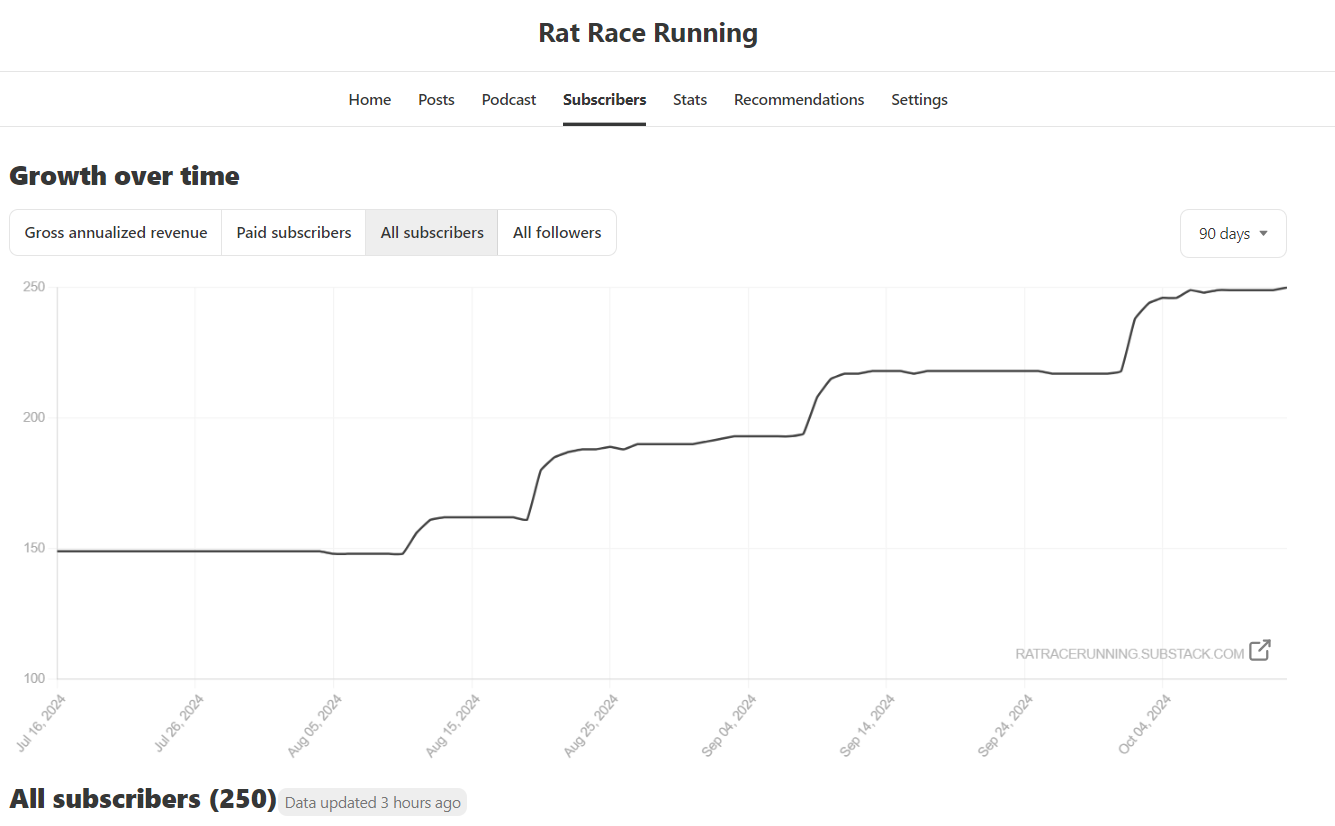

Substack: The newsletter finally reached 250 subscribers! Thank you everyone for your support. Special thanks to Boss

for the monthly collab! Each spike in the subscriber counts coincide with the publishing of MB Presents: Rat Race Running.

Facebook: We’re now at 27K! I don’t know if it’s possible, but I hope we can reach 35K by the end of year.

Typeshare: I am currently on a 239-day writing streak and Streak Rank #16 on the platform. I also think I’ll hit 100K words written this coming week.

There's nothing more exciting than coming out of college and working on your first job.

Finally, you will reap the rewards of your hard work and sacrifices. However, even if earning and spending money brings out a sense of accomplishment, it shouldn't be at the expense of your future. You wouldn't like to look back and realize that after working for 20 years, you still have no savings and are buried in debt.

So, even if there are hundreds of skills to learn about adulting, money skills should be at the top.

Money Skill #1: Budgeting (and Sticking to it).

Budgeting is a skill that connects to every other aspect of personal finance.

Unfortunately, budgeting a subpar salary as a single young professional is difficult - though not impossible.

So, if you learn to stick with your budget when you're younger, managing a higher income in the future will be easier.

Money Skill #2: Living Below Your Means.

Living below your means says you should never spend more than your income.

This is simple yet difficult to follow because we usually want immediate gratification.

However, if you don't learn to spend below what you earn and, worse, decide to spend the money you don't yet have, you will fall into the rat race trap.

Money Skill #3: Avoiding Consumer Debt.

Consumer debt seems normal because most adults have this, but it shouldn't be.

Consumer debts, like credit cards and personal loans, have trapped many into working a job they hate for decades because they can no longer afford to leave.

Don't fall into the notion that debt is necessary; instead, be a contrarian and live without debt, limiting your options.

Money Skill #4: Protecting Yourself.

Protecting yourself means having an emergency fund and an insurance plan.

These protections are crucial if you live somewhere without a working universal healthcare system, like the Philippines, where one major emergency is enough to cripple families instantly.

Protecting yourself also means protecting your family and your future.

Money Skill #5: Investing for Retirement.

Lastly, you need to start learning about investing for retirement the moment you start earning.

In order to do this, you need to learn as much as you can about investment vehicles while still not earning enough, then increase it as your income increases.

Remember, time is an excellent ally if you start early, but it is your worst enemy if you fail to prepare.

Adulting can be overwhelming; well, that's what it was for me because I didn't know where to start.

After graduating, I realized that I learned very little in school about life after school. So, when I started my adult life, I had to learn things on my own. Suddenly, my 20s became a discovery period, not knowing how my actions would translate into the future.

So, based on what I learned, here are some things I wish my younger self learned earlier.

Skill #1: Money Management.

Money management is one of the most crucial adulting skills to learn.

Since I never learned budgeting, tracking my expenses, living below my means, or investing from school, I had to learn them as I went. Some even cost me money to learn. It took me years before I finally built my system.

So, if you're a fresh graduate, start with budgeting and start your money management journey from there.

Skill #2: Cooking.

In order to save money while eating healthy, you must learn how to cook.

When I started living independently in Metro Manila at 24, I didn't know how to cook. Honestly, I only started cooking when my office crush shared that she likes Bicolano foods, so I had to show off (it didn't work, by the way). Once I learned cooking, I explored more recipes and tried healthier alternatives.

I realized nutrition is the foundation of a healthy lifestyle, which I can get by cooking.

Skill #3: Exercising.

It's frustrating to get back in shape after a decade of negligence.

When I started working, I was overweight. Then, I discovered running, which pushed me to lose weight. However, aside from the physical effects of exercise, it's the mental benefits that we need to foster.

If you feel like you don't have time to exercise, walking is a great place to start.

Skill #4: Writing.

I don't write for the sake of writing. I write because it helps me think.

Writing has been an underrated skill since graduating because it has always felt like a mandatory school requirement. However, I discovered that writing helps me crystallize my ideas and frameworks. It also enables me to trap my frustrations and stresses on paper.

I started writing in 2017 as a hobby, and I wouldn't have imagined making it my future career five years later.

RRR Thread of the Week:

Read the full thread here:

RRR Investment Update

Dividend Update: I’ve received all my expected dividends for October, so it may take a month or two before another dividend announcement. Here is my current asset allocation.

REIT Updates: $VREIT, $DDMPR, and $FILRT are now just the three REITs with more than 8% annualized yields, but don’t be blinded by those numbers, especially if fundamentals do not back them.

$PREIT had a good week, reaching a new 52WH of P2.25, before closing at P2.18. However, this surge in stock price also meant that its annualized yield took a downturn. Its dividend yield is now comparable to that of $AREIT.

Here are some notes from last week:

MREIT secures approval to acquire six assets worth P13.15-B. Read more.

DISCLAIMER: This is not a recommendation to buy, sell, or hold. I am only sharing this to show the difference between each REIT’s current dividend yield.

See you again next Monday at 8 AM Philippine Time — RRR

Did you enjoy this? Share it with a friend. ;)

Follow Me on Social Media:

Facebook - facebook.com/ratracerunning

Twitter/X - x.com/ratracerunning

Typeshare - typeshare.co/ratracerunning