#025: Living Debt-Free, Generational Opportunities, and

Read Time: 8 minutes

Speaking Time: 11 minutes

Here are the two better-performing articles for the week:

4 Reasons Why Living Debt-Free Will Give You a Better Life

The Levels of Escaping Poverty and Generational Opportunities

You’ll also find:

Rat Race Running Update

RRR Thread of the Week - 3 Reasons to Build an Emergency Fund Before Investing

RRR Trade of the Week

RRR Investment Update for the Week

RRR Updates:

Rat Race Running #3 was released in Boss Merkado Barkada’s newsletter titled:

4 Reasons You'll Probably Not Have Enough Money by the Time You Retire. Read the full post here:

Facebook: It happened like a blur. From 20K followers last week, we now have over 25K! I don’t know what happened, but I’ve seen a lot of traction on the page recently. Thank you for your support!

The page also racked up 5.3 million reach, 606k engagements, and 8.4k followers in the past 28 days, which is massive! The page had never experienced that kind of growth before.

Typeshare: There are some significant changes with Typeshare shipped this week, particularly the “Signal” metric.

I am currently on a 233-day writing streak and #15 among the 70,000+ writers on the platform.

I am also #28 in the signals ranking.

Travel Journal: My wife and I have been traveling in Australia and are currently at the last leg of the trip, being AU’s capital, Canberra. During our month-long trip, I noticed that Australia’s government respects the country’s history and struggles, as shown by its museums, customs, and practices. Unfortunately, we don’t have many of those in the Philippines, which is sad.

Debt seems normal to most adults, but it doesn't have to be.

When I talk to many adults in my previous jobs, they often make me feel that debt is as natural as death and taxes. They would also say you can't buy anything without getting into debt anymore. However, I took the other path and chose to live debt-free instead.

Here are four reasons why living debt-free will give you a better life than our consumeristic society promises.

#1. Freedom to Choose.

If you're debt-free, you will have more confidence and freedom to choose between new opportunities.

While teaching full-time, I had several co-faculties who were dying to resign but couldn't. They said they can't sacrifice the security their government job provides (even if they only take home P5,000 of their income because of debt). In my case, being debt-free was the reason I dared to leave a higher-paying job and pursue a lower-paying vocation.

Remember, your freedom to choose a life you want shouldn't be restricted by a debt you took 10 or 20 years ago.

#2. Improved Physical and Mental Health.

Debt is a plague on our physical and mental health.

I remember someone who got addicted to gambling, leading to millions in debt. Despite earning more than six figures monthly, the stress, constant fear, and anxiety brought by his debts were too much, pushing him to sleepless nights and depression. These negative emotions brought by debt soon took a toll on his physical health and immune system.

Aside from gambling, people also fall into credit card debt, expensive car and housing loans, and personal loans that cause too much mental and physical strain.

#3. Better Relationships with Family and Friends.

No one likes to hang out and associate themselves with serial money borrowers.

I know several people whose friendships and family relationships became strained by debt. These borrowers often disguise borrowing money for an emergency, but the truth is they use it to buy gadgets or go on vacations, and they usually never pay the money back as promised. The sad (but deserved) part is that if you've been labeled a serial borrower, people will start distancing themselves from you.

Remember, unpaid debts to family and friends are more than just money. It is about the broken trust and relationship that comes with it.

#4. More Disposable Income for Your Personal Goals.

If you don't have any debt, you will have more disposable income for your other goals.

You can use the money you'll pay as interest in debt to add to your savings and investments. You may also use the money you saved to buy better-quality gadgets, big-ticket items, or even vacations. Most importantly, it can finance your future goals, like education and retirement.

Avoiding debt is hard, but it's harder to sacrifice our future for something that loses its value.

Take control of your finances, seek help if needed, and be responsible. Your future self and family will thank you.

1/ The Trailblazers.

The Trailblazers are the family's first generation who never had easy opportunities growing up.

They may have been born poor, uneducated, and had to work at an early age. They sacrificed their lives to open up opportunities for the next generation - their children. They are likely to see the impact of their hard work through the next generations or even once they are in their sunset years.

The Trailblazers are our grandparents or great-grandparents who started from the bottom of the wheel of fate and worked blood and sweat in order to turn the wheel in their favor.

2A/ The Endurers.

The Endurers are those who were granted a step forward to a better life thanks to the Trailblazers.

Though they already had a relatively better taste of life than their parents, it's still far from the full meal. However, they will see the impact of their sacrifices within their generation.

Unfortunately, not every child of the Trailblazers will grow up to be Endurers. Sometimes, there will only be one or two people in a family, but it is enough to lift the others. The Endurers are also the sandwich generation.

Endurers will soon become parents and raise two groups of children - the Heirs and the Prodigals.

2B/ The Waiters.

The Waiters are the Endurers' siblings and children of the Trailblazers.

However, despite being given the same opportunities by their trailblazing parents, the Waiters are less enthusiastic and lazy. They just want to "wait" for their parents or Endurer siblings to bring down the rope that will pull them up from their current status.

Waiters are often entitled. They want to receive rewards without doing any hard work.

The Waiters will remain in their current status until one of their children or grandchildren develops into a Trailblazer - repeating the cycle.

3A/ The Heirs.

The Heirs are the Endurer's children who understand the sacrifices of the prior generations and won't let them go to waste.

So, they took every opportunity possible and continued working hard towards a better life while passing the lessons to the next generation. They will be the first generation to climb the upper middle class and beyond.

The Heirs may appear to be born on a silver spoon, but in reality, it took three generations to build.

The Heirs will go on to have children who will also be Heirs and continue the legacy and generational opportunities. However, their other children will be Prodigals who will turn the wheel back to the bottom.

3B/ The Prodigal.

The Prodigals will be the ones to end the cycle of prosperity that the older generations worked hard for and repeat the cycle of poverty.

Since they were never trained and taught the importance of hard work and were provided with an easy life, they didn't develop resilience and the value of sacrifice. As a result, the Prodigals, like the Biblical story of the Prodigal Son, will waste every opportunity given to them.

They will soon destroy everything the Trailblazers and the Endurers built and reset their family's wheel of fate towards poverty and hardship until the next Trailblazer arrives.

RRR Thread of the Week:

Read the full thread here:

RRR Trade of the Week

Disclaimer: This is strictly educational and is not a recommendation to buy or sell. I share both of my wins and losses to show new traders and investors the reality of the stock market.

I don’t have a trading plan for this week, as we are on a hectic travel itinerary and return flight home. However, I’ll continue to monitor the market to see if any opportunities arise.

My $OGP’s P/L is now above the stock’s annualized yield. However, since gold is trending upward in the commodities market, I think I’ll hold on to this stock for longer.

RRR Investment Update

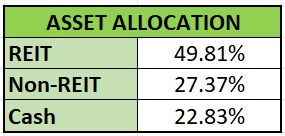

Dividend Update: I’ve received all my expected dividends for October so that it may take a month or two before another dividend announcement. Here is my current asset allocation.

REIT Updates: $VREIT, $DDMPR, and $FILRT continue to have the largest annualized yields among the eight REITs, but don’t be blinded by those numbers, especially if fundamentals do not back them. Here are some notes from last week:

$DDMPR declared a stable Q2 payment of ₱0.023561/share with ex-date on October 30. Read more.

DISCLAIMER: This is not a recommendation to buy, sell, or hold. I am only sharing this to show the difference between each REIT’s current dividend yield.

See you again next Monday at 8 AM Philippine Time — RRR

Did you enjoy this? Share it with a friend. ;)

Follow Me on Social Media:

Facebook - facebook.com/ratracerunning

Twitter/X - x.com/ratracerunning

Typeshare - typeshare.co/ratracerunning