#022: Personal Finance for Families, Old Status Symbols, and RRR Updates

Read Time: 7 minutes

Speaking Time: 9 minutes

Here are the two better-performing articles for the week:

4 Basic Personal Finance Steps For Your Typical Filipino Family

3 Old Status Symbols We Can Limit Paying Attention And Live A Simpler Life

You’ll also find:

Rat Race Running Update

RRR Thread of the Week - 3 Mistakes Stock Market Newcomers Make That Costs Them Money

RRR Trade of the Week

RRR Investment Update for the Week

RRR Updates:

MB Presents: Rat Race Running: RRR was once again featured in Merkado Barkada last week, and I’m happy to share that this will be a regular collaboration in which I write about personal finance basics.

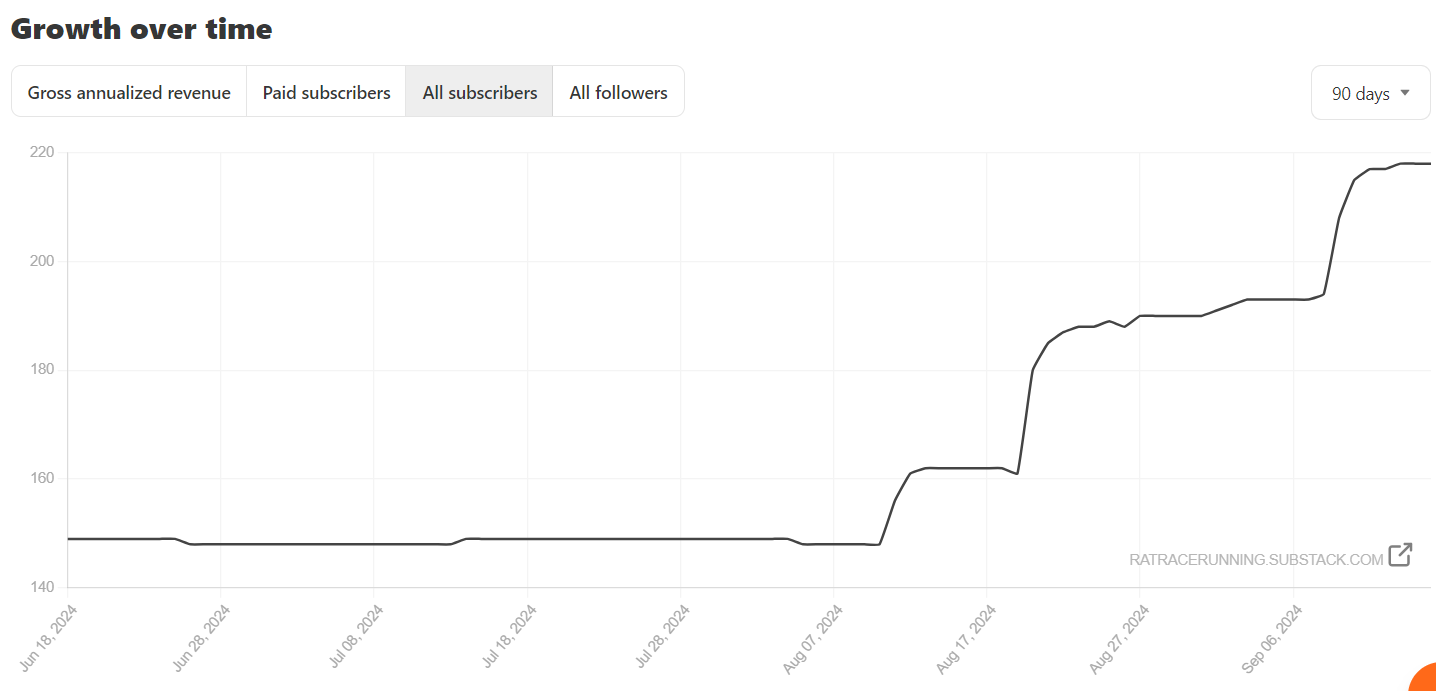

Substack: We finally breached the 200-subscriber threshold in Substack. A special thanks to Boss

, who always shares this newsletter with his followers. Also, a big shoutout to those who subscribed after seeing the link in Boss MB.

Typeshare: My writing streak in Typeshare has reached 211 consecutive days, with over 85,000 words written. I am also currently #19 in the ranking, with the longest streak among 75,000+ writers on the platform.

Article #1 - 4 Basic Personal Finance Steps For Your Typical Filipino Family

We can't put personal finance in a single formula that will work for everyone.

However, there are certain steps that are a good starting point, especially if you're starting your financial journey. I already wrote a version of Dave Ramsey's 7 Baby Steps for Filipinos (Atomic Essay #26), but I think the first four need more emphasis.

Here are four basic personal finance steps for your typical Filipino family.

Step 1: Save P10,000 as Your Starter Emergency Fund.

When you're still building your foundation, you should start with an emergency fund.

However, building for the standard 3-6 months emergency fund can be overwhelming. So, instead of saving hundreds of thousands of pesos at the get-go, start with just P10,000. This may not seem insignificant, but it will be enough for many minor emergency expenses.

Don't worry — the P10,000 is just your starting point. Once you get the hang of it, you'll eventually save more.

Step 2: Pay-off Any Existing Debt.

Debt hinders a better future, so if you don't have any debt now, please stay that way.

However, if you are in a debt cycle, it's best to find ways to pay them off immediately after saving the initial P10,000 emergency fund. You may need to spend less on your wants and find other sources of income. But you have to do it to open up new opportunities.

Once you pay off all your existing debt, you'll also feel relief.

Step 3: Save 12 Months's Worth of Emergency Funds.

Once you have paid off all your debt, it's time to complete your emergency fund.

Typically, we hear common financial advice that you only need 3-6 months' worth of emergency funds. Unfortunately, saving 3-6 months of expenses is probably not enough since we live in the Philippines. By saving at least 12-months worth of expenses, you will have more wiggle room, especially if you're a freelancer with no HMO.

It's crucial to save for this emergency fund before jumping to investing.

Step 4: Invest 20% of Your Household Income to Retirement.

Finally, it's the best time to invest once you have completed your emergency fund.

As a rule of thumb, 20% of your income invested is a great start for your retirement. It's crucial to have a separate retirement fund outside the GSIS or SSS. You can choose from many types of investments, but you need to study them thoroughly.

Your investments while young will become valuable in the future.

Article #2 - 3 Old Status Symbols We Can Limit Paying Attention And Live A Simpler Life

I believe the status game has changed for many Filipinos.

When I started working, I was also attracted by the idea of gaining status symbols to gain respect and admiration from others. Soon, I realized that it was a dead-end and purposeless game. Instead, I looked at the new status symbols of work flexibility, a debt-free lifestyle, and peace of mind.

I realized these three old status symbols should retire.

1/ Buying Overkill Big-Ticket Items

Big-ticket items, like a house or car, cost a lot of money.

I'm not saying you should not have a house or a car because it's still important, but it should be in the proper context and timing. For instance, if you're single, why would you buy a 5BR house that is harder to maintain? Also, why would you take a car loan when you're just starting your career and barely have enough for your needs?

There is a perfect season for everything. However, some people's primary goal for overkilling big-ticket items is to show everyone their success. Unfortunately, not everyone cares, and it becomes meaningless.

Too many loans will also take a toll on you physically and mentally. It will also limit your options.

2/ Playing the Status Game

The status game has been around for a long time, but it's not similar to what we have now.

Today, too many people want to gain a certain status in order to get admiration, amazement, and respect from others. That's why they would work hard to make their names longer by adding various acronyms at the start or end or climbing the career ladder to gain a fancy job title. For some, it's how much money they have in the bank.

I realized that playing the status game wouldn't bring the satisfaction I hoped for and that many who share this story would understand.

3/ Building a Facade

People love hiding behind the facade they made for themselves, conscious of what others will think of them.

I remember a colleague who always introduced himself using elaborate job titles and licenses, but if you ask him what he does for fun, he'll give you a blank stare. There is also someone who is generous to other people and has developed a facade of generosity but is closed-fisted to his family.

With the rise of social media, people's facades only grew worse, as many would only post their highlights, and FOMO and envy became the name of the game.

In the end, many old status symbols become empty and meaningless. So, leaving a part of you looking to serve others is essential.

RRR Thread of the Week:

Read the full thread here:

RRR Trade of the Week

Disclaimer: This is strictly educational and is not a recommendation to buy or sell. I share both of my wins and losses to show new traders and investors the reality of the stock market.

Since my $AREIT trade idea did not materialize, I just bought some additional shares of one of my current REIT holdings.

Trade Idea: $URC — this stock is among the PSE Dividend Yield (DivY) Index, which means it still pays a decent dividend to its investors. However, it has been sold lately. Similar to what I did the last time it went below P100, I’m looking to make a quick S/R trade for $URC.

The strategy is simple: Buy near support, sell at the immediate psychological resistance, and cut your losses if it goes below PHP 89.

RRR Investment Update

Dividend Update: I have already received three of the five dividend payments I expect for the next few months, and two more are to go. We’re also approaching the fourth quarter, so there may be some dividend announcements soon.

REIT Updates: $VREIT remains the only REIT over 10% with an annualized yield of 10.22%, followed by $DDMPR at 9.39% and $FILRT at 8.08%.

After an $AREIT sell-down two weeks again, it immediately regained buyer interest, which boosted its stock price. It’s back to sub-6% annual yield.

DISCLAIMER: This is not a recommendation to buy, sell, or hold. I am only sharing this to show the difference between each REIT’s current dividend yield.

See you again next Monday at 8 AM Philippine Time — RRR

Did you enjoy this? Share it with a friend. ;)

Follow Me on Social Media:

Facebook - facebook.com/ratracerunning

Twitter/X - x.com/ratracerunning

Typeshare - typeshare.co/ratracerunning